Paga launches Android customer transaction app

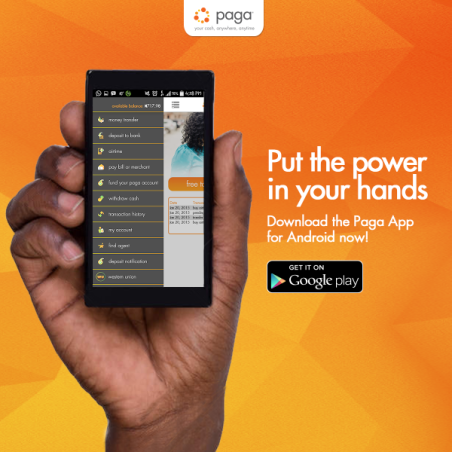

Paga, one of Nigeria’s leading mobile payment companies, has announced the launch of a new customer transaction channel - Paga for Android in a bid to make payment more accessible for its users.

The firm, in a statement explained that the application is available for download at Google play store. It also stated that the application designed by Paga’s in-house technical team, gives users direct access to Paga services from any android device.

In addition, with limited reliance on Internet, low data consumption and network connectivity the application, according to the firm, had been positioned to provide users with a better and faster experience.

Commenting on the launch of Paga for Android, the Head of Consumer Business at Paga, Daniel Oparison said: “At Paga our service offerings are carefully designed to respond to our customer’s pain points and this additional channel simply reinforces our commitment towards eliminating the stress of traffic, bank queues or carrying cash around.

“Paga for Android is designed to put the power back in the hands of the consumer; by giving them the freedom to pay their bills, buy airtime, and send money to bank accounts and much more, on the go.

“The ability to solve issues around payments unique to our region of the world, is one of the many reasons Paga continues to be the number one option for millions of Nigerians looking for simple solutions to pay and get paid.”

Furthermore, the statement stressed that in line with the company’s promise to deliver accessible payments options, the application allows users to transact with a debit card.

They can also use the app to send money or airtime directly to contacts on their phones list; or find their nearest Paga agent, it added.

Commenting on why Paga introduced the additional transaction channel to the market, the company’s Founder/CEO, Tayo Oviosu said: “Paga for Android brings a world of convenience to the fingertips of every Nigerian with an Android phone. I am very excited about that and about the various payment innovations we plan to bring to the market.

SOURCE:THISDAY

Africas leading resource for digital financial services

Africas leading resource for digital financial services

comments