Mobile e-money taking off in Côte d'Ivoire

ALLIANCE FOR FINANCIAL INCLUSION.

Located on the coast of West Africa, Côte d'Ivoire is a member of the West African Economic and Monetary Union (WAEMU). Spread over an area of ??322,460 sq km with a population of 20 million, the country is one of the rising examples of the dramatic affect of mobile e-money on financial inclusion largely due to a supportive policy and regulatory environment, a growing mobile phone penetration rate that has increased from 50 percent in 2008 to over 100 percent in 2014 and an active mobile e-money sector largely driven by new non-bank players.

As in many other countries in Africa, limited access to financial services, which had been previously limited to banks and microfinance players, is now being overcome by new non-bank mobile-enabled e-money players in Côte d'Ivoire. While access to banking and microfinance was only 21.8 percent at end 2013, the new digital e-money players are now helping drive financial access rates to approximately 66.3 percent of the population. The financial landscape in Côte d'Ivoire is now changing due to a dynamic sector, comprised of not only banks and microfinance institutions but also new e-money issuers. The whole sector is now changing to adopt digital financial services to support greater financial inclusion on a scale and growth rate that has even surpassed the uptake in even the well-known e-money markets in East Africa. It is also important to note that apart from the two new non-bank e-money institutions there are also six joint e-money partnerships between telecom operators and banks.

Dramatic Uptake of E-Money

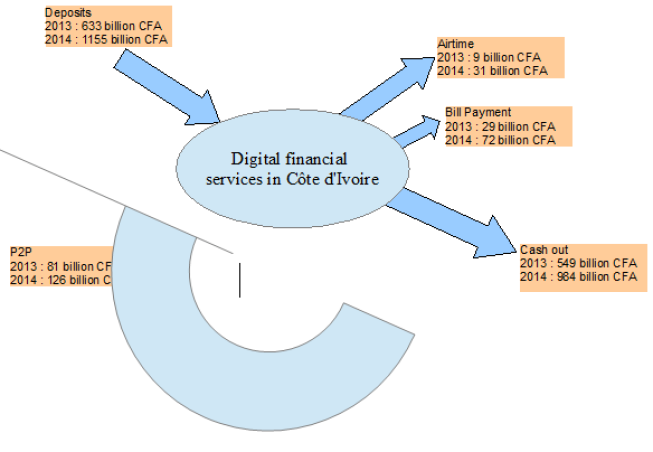

The overall performance indicators show that mobile enabled e-money services are growing on a per capita basis at one of the fastest rates of any country in Africa. By the end of 2014, there were over 4.6 million active e-money customers (up over 240 percent from 2013) which transferred more than CFA 2,233 billion ($4.6 billion) in transactions (up more than 186 percent from 2013). The agent network likewise grew from 10,752 from 2013 to 19,260 in 2014.

Table 1: Key indicators of E-Money in Côte d'Ivoire

This increase in the provision of financial services is largely due to the regulations introduced in by the Central Bank of West African States (BCEAO) that allowed the involvement of non-banks to issue, manage and distribute e-money as well as innovative partnerships between banks and telecom operators.

In addition, while the number of users expanded by more than 50 percent between 2013 to 2014, the number of active users declined from 61.5 percent to just 50 percent in 2014.

Table 2: Active E-Money users in Côte d'Ivoire

While money transfers still account for the largest number of transactions, there was also significant increase in bill payments and other financial services in 2014 which shows promise for deepening financial inclusion via e-money services going forward.

E-Money Transactions in 2013 and 2014

AMPI 2015

What other factors make Côte d'Ivoire one of the fastest growing mobile e-money markets in the world? Who are the players and what are they doing to deepen financial inclusion? This and other related questions will be discussed during the upcoming African Mobile Phone Financial Services Policy Initiative (AMPI) annual leaders roundtable meeting to be held in Côte d'Ivoire in July 2015.

Africas leading resource for digital financial services

Africas leading resource for digital financial services

comments